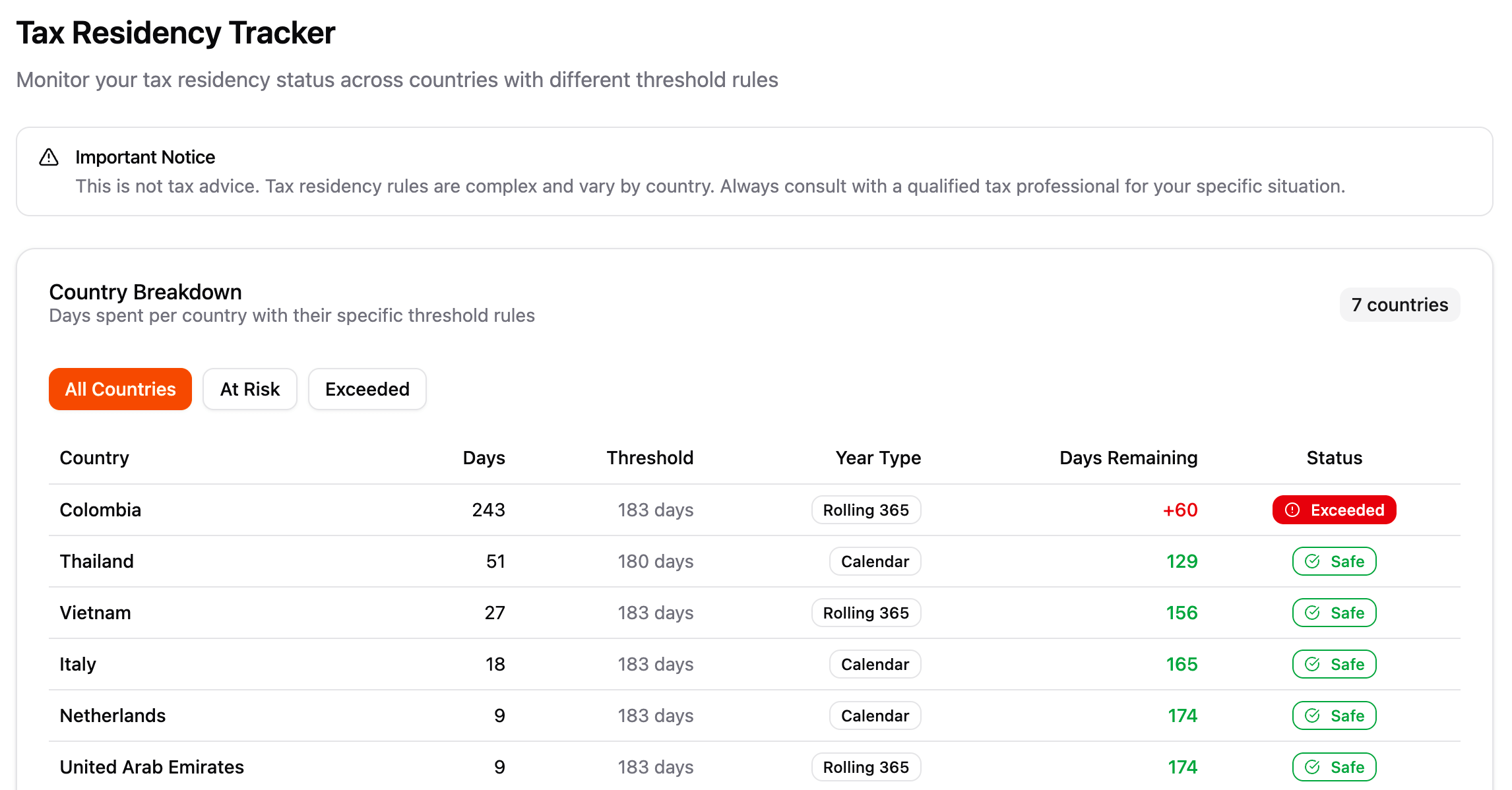

Track tax residency days for any country

Tax residency rules vary by country. Some count any presence, others use the midnight rule. Log trips once, get accurate day counts for every country using the right counting method.

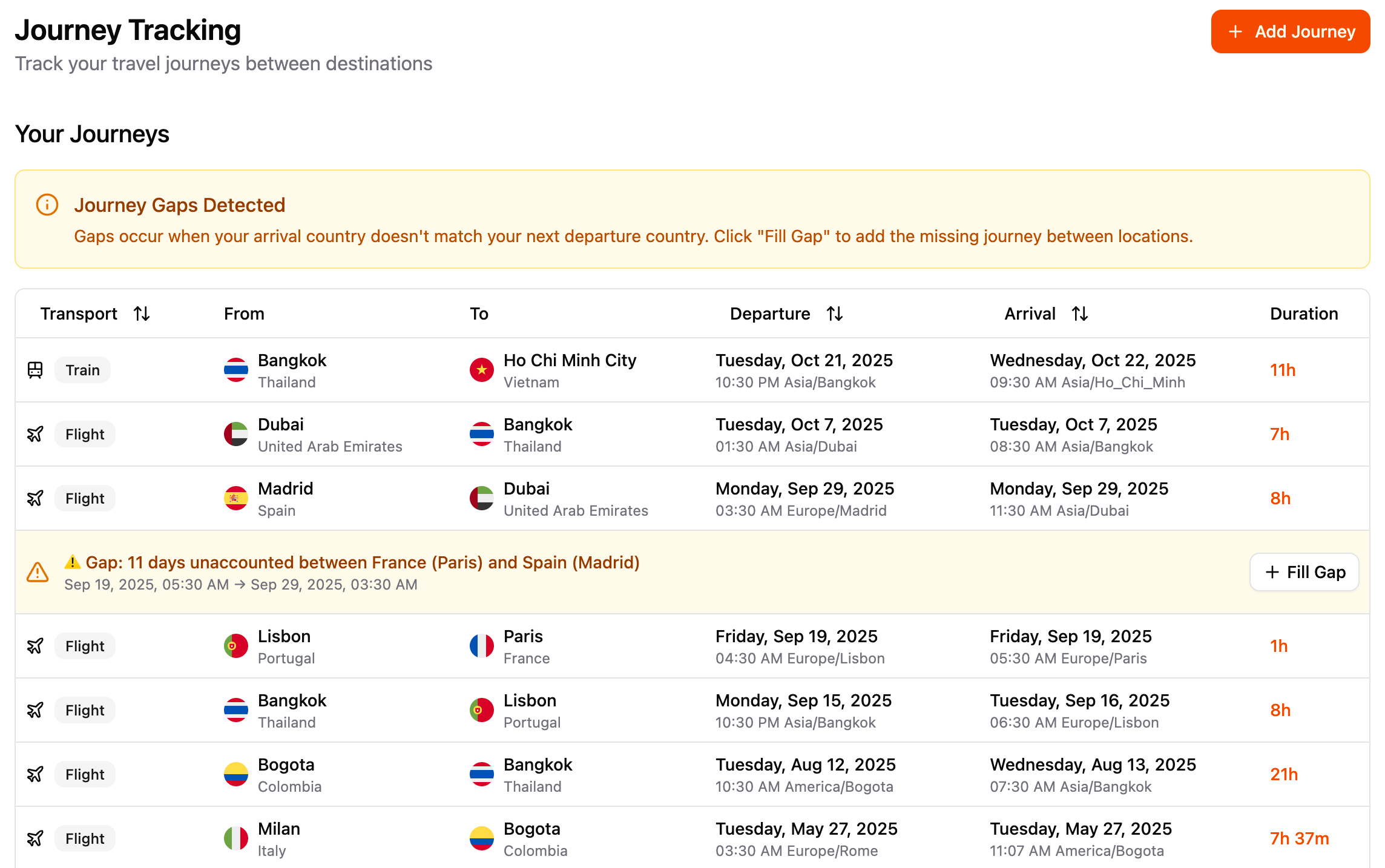

Dead simple journey logging

Stop recreating March from memory at tax time. Enter trips once, get day counts per country using the right counting method. Your accountant will thank you.

Add a trip in under 30 seconds

Departure city, arrival city, dates. That's it. We apply the right counting method (Any Presence or Midnight Rule) per country.

Cross-timezone flights counted correctly

Overnight flight from NYC to London? We figure out which calendar days you were physically present in each country.

Search 140,000+ cities by name

Type 'Bangkok' or 'Porto' and pick from the list. Timezone data already loaded.

Catch gaps before your accountant does

If your arrival country doesn't match your next departure, we flag it. Fill the gap or explain it later.

Tax residency is messy

Most countries determine tax residency based on physical presence — typically 183 days in a year. But the rules for counting those days vary widely.

The UK uses the Midnight Rule: you count a day only if you're there at midnight. The US uses Any Presence: stepping foot in the country for even an hour counts as a full day. Portugal has its own rules. So does Spain. And Thailand. And Dubai.

Get it wrong and you'll face penalties, double taxation, or worse — an audit from two countries at once.

How it counts your days

Any Presence & Midnight Rule

Both counting methods built in. Switch between them per country to match local tax rules.

Automatic day counting

Log your trips once. See your residency days calculated for every country you visit.

Catch missing days

Gap detection alerts you to untracked days so your records stay complete for tax filing.

Export for accountants

Generate reports your tax advisor can actually use. CSV exports with full trip details.

180+ countries supported

Track residency for Portugal, Thailand, Dubai, or anywhere else. Built-in timezone data for 140,000+ cities worldwide.

Built for people who need accurate counts

Digital nomads

Avoid becoming a tax resident somewhere you don't want to be. Track your days across multiple countries simultaneously.

Expats

Prove tax residency status with complete records. Especially useful for UK expats tracking the Midnight Rule.

Tax advisors

Give clients accurate day counts for their tax filings. Export clean data for your records.

File taxes with accurate records

Free forever. No credit card needed.

Calculate my tax residency days